波特五力分析模型Porter's FiveForces

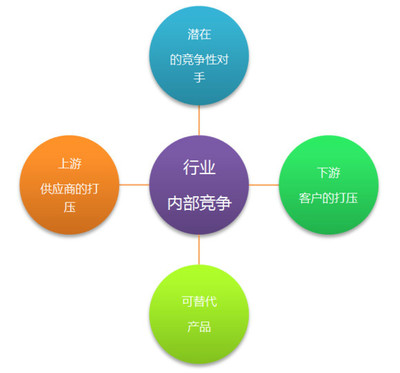

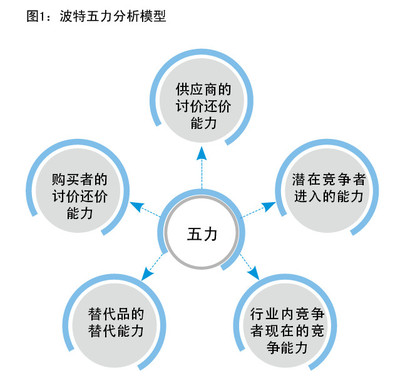

五力分析模型是迈克尔·波特(Michael Porter)于80年代初提出,对企业战略制定产生全球性的深远影响。用于竞争战略的分析,可以有效的分析客户的竞争环境。五力分别是: 供应商的议价能力、购买者的议价能力、潜在竞争者进入的能力、替代品的替代能力、行业内竞争者现在的竞争能力。五种力量的不同组合变化最终影响行业利润潜力变化。

五种力量模型将大量不同的因素汇集在一个简便的模型中,以此分析一个行业的基本竞争态势。五种力量模型确定了竞争的五种主要来源,即供应商和购买者的议价能力,潜在进入者的威胁,替代品的威胁,以及最后一点,来自目前在同一行业的公司间的竞争。一种可行战略的提出首先应该包括确认并评价这五种力量,不同力量的特性和重要性因行业和公司的不同而变化,如下图所示:

1.供应商的议价能力

供方主要通过其提高投入要素价格与降低单位价值质量的能力,来影响行业中现有企业的盈利能力与产品竞争力。供方力量的强弱主要取决于他们所提供给买主的是什么投入要素,当供方所提供的投入要素其价值构成了买主产品总成本的较大比例、对买主产品生产过程非常重要、或者严重影响买主产品的质量时,供方对于买主的潜在讨价还价力量就大大增强。一般来说,满足如下条件的供方集团会具有比较强大的讨价还价力量:

- 供方行业为一些具有比较稳固市场地位而不受市场剧烈竞争困挠的企业所控制,其产品的买主很多,以致于每一单个买主都不可能成为供方的重要客户。

- 供方各企业的产品各具有一定特色,以致于买主难以转换或转换成本太高,或者很难找到可与供方企业产品相竞争的替代品。

- 供方能够方便地实行前向联合或一体化,而买主难以进行后向联合或一体化。(注:简单按中国说法,店大欺客)

2.购买者的议价能力

购买者主要通过其压价与要求提供较高的产品或服务质量的能力,来影响行业中现有企业的盈利能力。一般来说,满足如下条件的购买者可能具有较强的讨价还价力量:

- 购买者的总数较少,而每个购买者的购买量较大,占了卖方销售量的很大比例。

- 卖方行业由大量相对来说规模较小的企业所组成。

- 购买者所购买的基本上是一种标准化产品,同时向多个卖主购买产品在经济上也完全可行。

- 购买者有能力实现后向一体化,而卖主不可能前向一体化。(注:简单按中国说法,客大欺主)

3.新进入者的威胁

新进入者在给行业带来新生产能力、新资源的同时,将希望在已被现有企业瓜分完毕的市场中赢得一席之地,这就有可能会与现有企业发生原材料与市场份额的竞争,最终导致行业中现有企业盈利水平降低,严重的话还有可能危及这些企业的生存。竞争性进入威胁的严重程度取决于两方面的因素,这就是进入新领域的障碍大小与预期现有企业对于进入者的反应情况。

进入障碍主要包括规模经济、产品差异、资本需要、转换成本、销售渠道开拓、政府行为与政策(如国家综合平衡统一建设的石化企业)、不受规模支配的成本劣势(如商业秘密、产供销关系、学习与经验曲线效应等)、自然资源(如冶金业对矿产的拥有)、地理环境(如造船厂只能建在海滨城市)等方面,这其中有些障碍是很难借助复制或仿造的方式来突破的。预期现有企业对进入者的反应情况,主要是采取报复行动的可能性大小,则取决于有关厂商的财力情况、报复记录、固定资产规模、行业增长速度等。总之,新企业进入一个行业的可能性大小,取决于进入者主观估计进入所能带来的潜在利益、所需花费的代价与所要承担的风险这三者的相对大小情况。(注:潜在的同行,跟风者)

4.替代品的威胁

两个处于同行业或不同行业中的企业,可能会由于所生产的产品是互为替代品,从而在它们之间产生相互竞争行为,这种源自于替代品的竞争会以各种形式影响行业中现有企业的竞争战略。首先,现有企业产品售价以及获利潜力的提高,将由于存在着能被用户方便接受的替代品而受到限制;第二,由于替代品生产者的侵入,使得现有企业必须提高产品质量、或者通过降低成本来降低售价、或者使其产品具有特色,否则其销量与利润增长的目标就有可能受挫;第三,源自替代品生产者的竞争强度,受产品买主转换成本高低的影响。总之,替代品价格越低、质量越好、用户转换成本越低,其所能产生的竞争压力就强;而这种来自替代品生产者的竞争压力的强度,可以具体通过考察替代品销售增长率、替代品厂家生产能力与盈利扩张情况来加以描述。

5.同业竞争者的竞争程度

大部分行业中的企业,相互之间的利益都是紧密联系在一起的,作为企业整体战略一部分的各企业竞争战略,其目标都在于使得自己的企业获得相对于竞争对手的优势,所以,在实施中就必然会产生冲突与对抗现象,这些冲突与对抗就构成了现有企业之间的竞争。现有企业之间的竞争常常表现在价格、广告、产品介绍、售后服务等方面,其竞争强度与许多因素有关。

一般来说,出现下述情况将意味着行业中现有企业之间竞争的加剧,这就是:行业进入障碍较低,势均力敌竞争对手较多,竞争参与者范围广泛;市场趋于成熟,产品需求增长缓慢;竞争者企图采用降价等手段促销;竞争者提供几乎相同的产品或服务,用户转换成本很低;一个战略行动如果取得成功,其收入相当可观;行业外部实力强大的公司在接收了行业中实力薄弱企业后,发起进攻性行动,结果使得刚被接收的企业成为市场的主要竞争者;退出障碍较高,即退出竞争要比继续参与竞争代价更高。在这里,退出障碍主要受经济、战略、感情以及社会政治关系等方面考虑的影响,具体包括:资产的专用性、退出的固定费用、战略上的相互牵制、情绪上的难以接受、政府和社会的各种限制等。

行业中的每一个企业或多或少都必须应付以上各种力量构成的威胁,而且客户必面对行业中的每一个竞争者的举动。除非认为正面交锋有必要而且有益处,例如要求得到很大的市场份额,否则客户可以通过设置进入壁垒,包括差异化和转换成本来保护自己。当一个客户确定了其优势和劣势时(参见SWOT分析),客户必须进行定位,以便因势利导,而不是被预料到的环境因素变化所损害,如产品生命周期、行业增长速度等等,然后保护自己并做好准备,以有效地对其它企业的举动做出反应。

根据上面对于五种竞争力量的讨论,企业可以采取尽可能地将自身的经营与竞争力量隔绝开来、努力从自身利益需要出发影响行业竞争规则、先占领有利的市场地位再发起进攻性竞争行动等手段来对付这五种竞争力量,以增强自己的市场地位与竞争实力。

波特五力分析模型的缺陷

实际上,关于五力分析模型的实践运用一直存在许多争论。目前较为一致的看法是:该模型更多是一种理论思考工具,而非可以实际操作的战略工具。

该模型的理论是建立在以下三个假定基础之上的:

1、制定战略者可以了解整个行业的信息,显然现实中是难于做到的;

2、同行业之间只有竞争关系,没有合作关系。但现实中企业之间存在多种合作关系,不一定是你死我活的竞争关系;

3、行业的规模是固定的,因此,只有通过夺取对手的份额来占有更大的资源和市场。但现实中企业之间往往不是通过吃掉对手而是与对手共同做大行业的蛋糕来获取更大的资源和市场。同时,市场可以通过不断的开发和创新来增大容量。

因此,要将波特的竞争力模型有效地用于实践操作,以上在现实中并不存在的三项假设就会使操作者要么束手无策,要么头绪万千。

波特的竞争力模型的意义在于,五种竞争力量的抗争中蕴含着三类成功的战略思想,那就是大家熟知的:成本领先战略、差异化战略、集中战略。

Porter's Five Forces

The Porter's 5 Forces tool is asimple but powerful tool for understanding where power lies in abusiness situation. This is useful, because it helps you understandboth the strength of your current competitive position, and thestrength of a position you're considering moving into.

With a clear understanding of wherepower lies, you can take fair advantage of a situation of strength, improve a situation ofweakness, and avoid taking wrong steps.This makes it an important part of your planningtoolkit.

Conventionally, the tool is used toidentify whether new products, services or businesses have thepotential to be profitable. However it can be very illuminatingwhen used to understand the balance of power in other situationstoo.

Understanding the Tool:

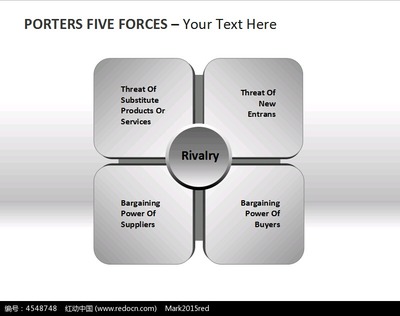

Five Forces Analysis assumes thatthere are five important forces that determine competitive power ina business situation. These are:

Supplier Power: Here you assess howeasy it is for suppliers to drive up prices. This is driven by thenumber of suppliers of each key input, the uniqueness of theirproduct or service, their strength and control over you, the costof switching from one to another, and so on. The fewer the supplierchoices you have, and the more you need suppliers' help, the morepowerful your suppliers are.

Buyer Power: Here you ask yourselfhow easy it is for buyers to drive prices down. Again, this isdriven by the number of buyers, the importance of each individualbuyer to your business, the cost to them of switching from yourproducts and services to those of someone else, and so on. If youdeal with few, powerful buyers, then they are often able to dictateterms to you.

Competitive Rivalry: What isimportant here is the number and capability of your competitors. Ifyou have many competitors, and they offer equally attractiveproducts and services, then you'll most likely have little power inthe situation, because suppliers and buyers will go elsewhere ifthey don't get a good deal from you. On the other hand, if no-oneelse can do what you do, then you can often have tremendousstrength.

Threat of Substitution: This isaffected by the ability of your customers to find a different wayof doing what you do – for example, if you supply a unique softwareproduct that automates an important process, people may substituteby doing the process manually or by outsourcing it. If substitutionis easy and substitution is viable, then this weakens yourpower.

Threat of New Entry: Power is alsoaffected by the ability of people to enter your market. If it costslittle in time or money to enter your market and competeeffectively, if there are few economies of scale in place, or ifyou have little protection for your key technologies, then newcompetitors can quickly enter your market and weaken your position.If you have strong and durable barriers to entry, then you canpreserve a favorable position and take fair advantage ofit.

These forces can be neatly broughttogether in a diagram like the one below:

Using the Tool:

To use the tool to understand yoursituation, look at each of these forces one-by-one and write yourobservations on our free worksheetwhich you can download here.

Brainstorm the relevant factors for your market or situation, andthen check against the factors listed for the force in the diagramabove.

Then, mark the key factors on the diagram, and summarize the sizeand scale of the force on the diagram. An easy way of doing this isto use, for example, a single "+" sign for a force moderately inyour favor, or "--" for a force strongly against you (you can seethis in the example below).

Then look at the situation you find using this analysis and thinkthrough how it affects you. Bear in mind that few situations areperfect; however looking at things in this way helps you thinkthrough what you could change to increase your power with respectto each force. What’s more, if you find yourself in a structurallyweak position, this tool helps you think about what you can do tomove into a stronger one.

This tool was created by HarvardBusiness School professor, Michael Porter, to analyze theattractiveness and likely-profitability of an industry. Sincepublication, it has become one of the most important businessstrategy tools. The classic article which introduces it is "HowCompetitive Forces Shape Strategy" in Harvard Business Review 57,March - April 1979, pages 86-93. |

Example:

Martin Johnson is deciding whether toswitch career and become a farmer - he's always loved thecountryside, and wants to switch to a career where he's his ownboss. He creates the following Five Forces Analysis as he thinksthe situation through:

This worries him:

The threat of new entry is quitehigh: if anyone looks as if they’re making a sustained profit, newcompetitors can come into the industry easily, reducingprofits.

Competitive rivalry is extremelyhigh: if someone raises prices, they’ll be quickly undercut.Intense competition puts strong downward pressure onprices.

Buyer Power is strong, again implyingstrong downward pressure on prices.

There is some threat ofsubstitution.

Unless he is able to find some way ofchanging this situation, this looks like a very tough industry tosurvive in. Maybe he'll need to specialize in a sector of themarket that's protected from some of these forces, or find arelated business that's in a stronger position.

Key points:

Porter's Five Forces Analysis is animportant tool for assessing the potential for profitability in anindustry. With a little adaptation, it is also useful as a way ofassessing the balance of power in more generalsituations.

It works by looking at the strengthof five important forces that affect competition:

Supplier Power: The power ofsuppliers to drive up the prices of your inputs.

Buyer Power: The power of yourcustomers to drive down your prices.

Competitive Rivalry: The strength ofcompetition in the industry.

The Threat of Substitution: Theextent to which different products and services can be used inplace of your own.

The Threat of New Entry: The easewith which new competitors can enter the market if they see thatyou are making good profits (and then drive your pricesdown).

By thinking about how each forceaffects you, and by identifying the strength and direction of eachforce, you can quickly assess the strength of your position andyour ability to make a sustained profit in the industry.

爱华网

爱华网