As Its Economy Sprints Ahead, China’s People Are Left Behind

By DAVID BARBOZA October 08, 2012

审视中国模式

中国,脆弱的中产家庭

DAVID BARBOZA 报道 2012年10月08日

JILIN CITY, China — Wang Jianping and his wife, Shue, are a relatively affluent Chinese couple, with an annual household income of $16,000 — more than double the national average for urban families.

中国吉林——王建平(音)和他的妻子淑娥(音)在中国算是相对富裕的一对夫妇。他们有相当于1.6万美元的家庭年收入,是中国平均城市家庭收入的两倍以上。

They own a modest, three-bedroom apartment here in this northeastern industrial city. They paid for their son to study electrical engineering at prestigious Tsinghua University, in Beijing. And even by frugal Asian standards, they are prodigious savers, with $50,000 in a state-run bank.

他们在这座位于中国东北部的工业城市里拥有一套面积不算太大的三居室住房,还支付了自己的儿子去北京著名的清华大学学习电气工程的学费。即便用节俭的亚洲标准衡量,这对夫妇的节省程度也很惊人,他们在一家国有银行里有相当于5万美元的存款。

But like many other Chinese families, the Wangs feel pressed. They do not own a car, and they rarely go shopping or out to eat. That is because the value of their nest egg is shrinking, through no fault of their own.

然而,和很多其他的中国家庭一样,王家人仍感到有很大的经济压力。他们没有车,而且很少去购物或者到外面吃饭。这是因为,他们的储蓄金正在贬值,虽然这不是他们的过错。

Shiho Fukada for The New York Times

吉林市一条繁忙的购物街上,一个商贩在打盹。在吉林等内陆城市,洋品牌的市场份额远远小于大城市。

Under an economic system that favors state-run banks and companies over wage earners, the government keeps the interest rate on savings accounts so artificially low that it cannot keep pace with China’s rising inflation. At the same time, other factors in which the government plays a role — a weak social safety net, depressed wages and soaring home prices — create a hoarding impulse that compels many people to keep saving anyway, against an uncertain future.

在这样一个偏袒国有银行和国有企业、而非工薪阶层的经济体系中,政府人为地把存款利率压得很低,使其跟不上中国不断上涨的通货膨胀。同时,薄弱的社会安全网、过低的工资水平,以及飙升的房价等其他由政府影响的因素,制造了一种囤积的冲动,促使很多人不断地储蓄,以防患不确定的未来。

Indeed, economists say this nation’s decade of remarkable economic growth, led by exports and government investment in big projects like China’s high-speed rail network, has to a great extent been underwritten by the household savings — not the spending — of the country’s 1.3 billion people.

的确,正如经济学家所说,出口和政府在高速铁路系统等大型项目上的投资推动了中国经济这十年间的飞速发展。在很大程度上,这些投资的背后不是消费,而是家庭储蓄——13亿中国人的存款。

This system, which some experts refer to as state capitalism, depends on the transfer of wealth from Chinese households to state-run banks, government-backed corporations and the affluent few who are well enough connected to benefit from the arrangement.

一些专家把这种体系称为国家资本主义,它依靠把中国普通家庭的财富转移到国有银行、政府支持的企业,以及 那些与该体系有密切关系、得以从中牟利的少数富裕者手中。

Meanwhile, striving middle-class families like the Wangs are unable to enjoy the full fruits of China’s economic miracle.

与此同时,像王建平夫妇这些正在努力奋斗的中产阶级家庭,却无法享受到中国经济奇迹的全部果实。

“This is the foundation of the whole system,” said Carl E. Walter, a former J. P. Morgan executive who is co-author of “Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise.”

摩根大通(J. P. Morgan)的前任高管卡尔·E·沃尔特(Carl E. Walter)说,“这是整个体系的基础。”他是《红色资本主义:中国非凡崛起之下的脆弱金融基础》(Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise)一书的共同作者。

“The banks make loans to who the Communist Party tells them to,” Mr. Walter said. “So they punish the household savers in favor of the state-owned companies.”

沃尔特说,“银行听从共产党的安排来决定向谁发放贷款。所以,他们牺牲了普通家庭储户的利益,来为国有企业谋利。”

It is not just China’s problem. Economists say that for China to continue serving as one of the world’s few engines of economic growth, it will need to cultivate a consumer class that buys more of the world’s products and services, and shares more fully in the nation’s wealth.

这并不仅仅是中国的问题。经济学家指出,如果中国要继续充当世界上为数不多的经济增长引擎之一,就必须培育出一个能够从世界上购买更多产品和服务、并能更充分地分享国家财富的消费阶层。

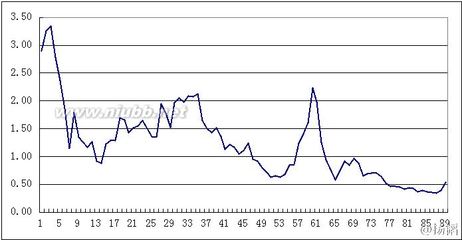

But rather than rising, China’s consumer spending has actually plummeted in the last decade as a portion of the overall economy, to about 35 percent of gross domestic product, from about 45 percent. That figure is by far the lowest percentage for any big economy anywhere in the world. (Even in the sleepwalking American economy, the level is about 70 percent of G.D.P.)

然而,过去十年间,中国的消费支出在整体经济当中所占的比重非但没有增长,反而显著下跌,从占国内生产总值的45%降到了35%。目前,这个数字在世界上所有大经济体中位于最低水平。(即便在美国当前非常不景气的经济情况下,这个比重也在70%左右。)

Unless China starts giving its own people more spending power, some experts warn, the nation could gradually slip into the slow-growth malaise that now afflicts the United States, Europe and Japan. Already this year, China’s economic growth rate has begun to cool off.

一些专家发出警告,除非中国提高自己国民的消费能力,她很可能会逐渐陷入经济缓慢增长的困境,目前美国、欧洲及日本就处于这种状况。就今年来看,中国的经济增长已经开始降温。

“This growth model is past its sell-by date,” says Michael Pettis, a professor of finance at Peking University and senior associate at the Carnegie Endowment for International Peace. “If China is going to continue to grow, this system will have to change. They’re going to have to stop penalizing households.”

“这种增长模式已经过时了,”北京大学金融学教授、卡内基国际和平基金会(Carnegie Endowment for International Peace) 非常驻高级研究员迈克尔·佩蒂斯(Michael Pettis)说。“如果中国要持续增长,就必须改变这个体制。他们必须停止损害普通家庭的利益。”

The Communist Party, in its latest five-year plan, has promised to bolster personal consumption. But doing so would risk undermining a pillar of the country’s current financial system: the household savings that support the government-run banks.

中国共产党在最新的五年计划中允诺要推动个人消费。然而,这么做有一个风险,会损害中国当前金融体系的一个支柱:为国有银行提供资金的家庭储蓄。

Here in Jilin City, where chemical manufacturing is the dominant industry, the state banks are flush with money from savings accounts. The banks use that money to make low-interest loans to corporate beneficiaries — including real estate developers, helping fuel a speculative property bubble that has raised housing prices beyond the reach of many consumers. It is a dynamic that has played out in dozens of cities throughout China.

在吉林这座以化工制造为支柱产业的城市中,国有银行因拥有大量的储蓄账户而资金充沛。银行以低息将这些资金借贷给企业受益人,其中包括房产开发商,进而推助了房地产投机的泡沫,使房价涨到了很多消费者都无法企及的水平。很多中国城市都靠这种模式发展。

Meanwhile, China’s central bank in Beijing also depends on the nation’s vast pool of consumer savings to help finance its big investments in the foreign exchange markets, as a way to keep the currency artificially weak. The weak currency helps sustain China’s mighty export economy by lowering the global price of Chinese goods. But it also makes imports unaffordable for many Chinese people.

同时,位于北京的中国央行,也依赖于中国巨额的消费者储蓄来帮助其在外汇市场上进行大笔投资,从而人为地将人民币汇率维持在较低水平。人民币的低汇率使中国商品在国际市场上保持低价,维系了中国强大的出口经济。但这样做使很多中国人买不起进口商品。

News reports of the nouveaux riches in Beijing and Shanghai snapping up Apple iPhones, Gucci bags and Rolex watches may conjure Western business dreams of China’s becoming the world’s biggest consumer market. But consumer choice here in Jilin and many other heartland cities is confined largely to the limited offerings of dingy state-run department stores and mom-and-pop shops. Any sales of global “brands” come mainly in the form of the counterfeits and knockoffs often sold at outdoor markets.

关于北京和上海地区的新贵阶层抢购苹果手机(Apple iPhone)、古驰(Gucci)手袋,以及劳力士(Rolex)手表的新闻报道,可能会让西方做起商业美梦,以为中国正在成为世界最大的消费市场。然而,在吉林和很多内地城市,消费者的选择仍然限于暗淡的国营商场和家庭店铺。这些城市里的国际“名牌”大多是露天市场上卖的冒牌货和仿制品。

On a recent weekday at the Henan Street flea market, crowds sifted through stacks of clothes that included $3 T-shirts with images of Minnie Mouse and $5 imitation Nike sports jerseys. Just a few yards away, an authentic Nike store selling the real thing for $35 had nary a shopper. Because consumers have so little spending power, many global-brand companies do not even bother to open stores in cities like Jilin.

在河南街旧货市场上最近一个工作日里,人们在一堆堆衣服中挑挑拣拣,其中有要价3美元的印着米老鼠图案的T恤,还有5美元一件的仿冒耐克(Nike)运动装。仅在几米之外,有一家耐克专卖店,里面出售的正品要价35美元,但却没有一个顾客光临。因为消费者的购买力太低,很多国际品牌都不屑于在吉林这样的城市开设专卖店。

With the faltering economies of the United States, Europe and Japan limiting China’s ability to continue relying on growth through exports, the Chinese government knows the importance of giving its own consumers more buying power. Already, the central government has pushed to raise rural incomes and has even offered subsidies to buy cars and household appliances.

随着美国、欧洲和日本的经济形势走低,中国继续依赖出口来促进经济增长的能力正在受到限制。中国政府明白,赋予中国消费者更多购买力有多么重要。中央政府已经开始着手提高农民收入水平,甚至还为他们购买汽车和家用电器提供了一系列补贴。

The question is whether the government can change its entrenched economic system enough to truly make a difference. “The central government is committed to increasing the share of consumption in G.D.P.,” says Li Daokui, a professor of economics at Tsinghua University and a longtime government adviser. “The issue is what is going to be the means.”

问题是,政府是否能改变中国根深蒂固的经济体系以产生真正的效果。“中央政府承诺,要提高消费在GDP中所占的份额,”长期担任政府顾问的清华大学经济学教授李稻葵说。“问题是,应该怎样提高。”

THE SAVERS:Frugality BornOf Necessity

储户:生来节俭不得已而为之

If China is to make consumer spending a much larger share of the economy, it will need to encourage big changes in the habits of people like Mr. Wang, 52, a highway design specialist, and Ms. Wang, also 52, who retired as an accountant seven years ago because of health problems.

如果中国要提高消费在经济中所占的份额,就必须鼓励像王建平这样的人大大地改变他们的习惯。现年52岁的王建平是一个公路设计专家,与他同龄的妻子曾是一名会计,七年前因为健康原因退休。

“We’re quite traditional,” says Ms. Wang, who draws a pension. “We don’t like to spend tomorrow’s money today.”

“我们十分传统,”以养老金为主要收入的王太太说。“我们不愿意今天花明天的钱。”

But tomorrow’s money may not be worth as much as today’s — not as long as their savings account earns only a 3 percent interest rate while inflation lopes along at 6 percent or more.

但是,明天的钱也许不像今天的这样值钱,尤其是在储蓄账户只有3%的利率,而通货膨胀率达6%甚至更高的情况下。

Yet the Wangs see no good alternatives to stashing nearly two-thirds of their monthly income in the bank. They are afraid to invest in China’s notoriously volatile stock market. And Chinese law sharply limits their ability to invest overseas or otherwise send money outside the country.

然而,除了把月收入的近三分之二存放到银行里,王家人找不到更好的选择。他们害怕把钱投到中国因波动剧烈而恶名远扬的股票市场。而且,中国法律严格限制了他们在海外投资、或者以其他方式把资金转移到境外的能力。

Nor do the Wangs feel flush or daring enough to join the real estate speculation that some Chinese now see as one of the few ways to get a return on their money — risky as that might prove if the bubble bursts.

王家人也没有充足的资金或者足够的勇气,去参与房地产投机。目前,一些中国人把这种方法视为获取投资回报的少数几种方法之一,泡沫一旦破裂,就能证明这样做是多么冒险。

Mainly, like many in China, the Wangs save because they worry about soaring food prices and the high cost of health care, which the People’s Republic no longer fully provides. They also worry about whether they can afford to buy a home for their son, a cost that Chinese parents are expected to bear when their male children marry.

和很多中国人一样,王家人存款是因为他们担心飞涨的食品价格和高昂的医疗费用,人民共和国早已不提供公费医疗了。他们也为能否给儿子买一套房而担心,在中国,人们指望父母能为自己的儿子结婚时承担这项花销。

“If you have a daughter, it’s not so expensive,” Wang Shue said. “But with a son you have to save money.”

“如果你有女儿,花费就不会这么大,”王淑娥说。“但如果有儿子,你就得存钱。”

Housing prices have become crucial in pushing up savings rates. Here, too, analysts say government policies are shifting wealth away from households.

房价已经成为推动百姓增加储蓄的关键因素。分析人士说,在这方面,政府的政策也正在把财富从普通家庭手中转移出去。

In the case of the Wangs, they are being forced to move to make way for a new real estate development authorized by municipal authorities — the sort of project that local governments throughout China have come to regard as an easy source of riches.

以王家人为例,他们正在被迫搬迁,为市政府授权的新房地产开发项目腾地。中国各地政府都把这类开发项目当做一种轻而易举的赚钱途径。

Although the Wangs and other current residents have received some cash compensation for the apartments they are leaving, the Jilin City government has sold the land to a developer that plans to demolish the current dwellings and erect a new complex with more, and more expensive, apartments.

虽然王家人和其他住户都得到了一定数额的拆迁补偿,但是吉林市政府把那块土地卖给了一个开发商,而这个开发商则打算拆除现有的住宅楼,修建一个更高密度、更加昂贵的新住宅区。

The Wangs are not sure they will be able to find a home comparable to their current apartment from the money they are being paid. But the developer and the local government are expected jointly to earn a profit of more than $50 million.

王家人不知道他们能否用所得到补偿金买到一套与自己现在住的差不多的房子。但据估计,开发商和当地政府将会共同获得超过相当于5000万美元(约3亿元人民币)的利润。

A POLICY’S HISTORY:Averting a Crisis,But Forming a Habit

政策的历史:防止了一次危机,却培养了一种习惯

Why would China, which hopes eventually to surpass the United States as the world’s biggest economy, deliberately suppress the consumer market that might help it reach that goal?

中国希望最终能够超过美国,成为世界上最大的经济体,但为什么故意压制能够帮实现这个目标的消费者市场呢?

Some analysts trace the current policies to habits formed in the late 1990s. That’s when the bloat of China’s giant, uncompetitive state-run corporations nearly brought China’s economic expansion to a standstill. Suddenly, with state-owned companies facing bankruptcy, the state banks were saddled with hundreds of billions of dollars in nonperforming loans; many banks faced insolvency.

一些分析人士指出,当前的政策源于20世纪90年代末期所形成的习惯。那时,中国庞大且无竞争力的国营企业的膨胀,几乎使中国的经济发展陷入停滞。突然间,随着国有企业濒临破产,国有银行里充斥了几千亿美元的不良贷款;很多银行也随之面临破产。

To avert a crisis, Beijing allowed state-owned companies to lay off tens of millions of workers. In 1999 just one of those companies, the parent of PetroChina, a big oil conglomerate, announced the layoff of a million employees. And to shore up the banks, Beijing assumed tighter control over interest rates, which included sharply lowering the effective rates paid to depositors. A passbook account that might have earned 3 percent in 2002, after inflation, would today be effectively losing 3 to 5 percent, once inflation is factored in.

为了避免发生危机,中国政府批准国有企业让几千万职工下岗。1999年,其中一家、也就是大型石油集团中国石油天然气股份有限公司的前身,宣布解雇了100万职工。为了支撑银行,政府加紧了对利率的控制,包括大幅度降低支付给储户的实际利率。定期储户在2002年可以得到排除通胀因素之后3%的利率,而如今,如果把通货膨胀考虑进去的话,这些储户实际上会损失3%到5%。

That is how Chinese banks can provide extremely cheap financing to state-owned companies while still recording huge profits. It has also helped the banks provide easy financing for big public works projects, which besides the high-speed train system have included the 2008 Beijing Olympics and the monumental Three Gorges Dam.

这就是为什么中国的银行能够给国有企业提供极其廉价的资金,同时也能获得大笔利润的原因。这也是银行能为大型基础设施和市政工程项目提供充裕资金的原因。除了高铁,还有2008年北京奥运会,以及巨大无比的三峡水坝。

It was during this same period that the Communist government discarded the longstanding “iron rice bowl” promise of lifelong employment and state care. Beijing shifted more of the high costs of social services — including housing, education and medical care — onto households and the private sector.

就是在这个时期,中国共产党政府打破了存在已久的“铁饭碗”制度,不再提供终生就业和由国家包管生老病死的福利。政府将社会服务——包括住房、教育、和医疗——的高额成本更多地转嫁到了普通家庭和私营企业身上。

Together, these measures added up to the managed-market system now known as state capitalism. They worked so well that they not only helped resuscitate China’s failing banks and state companies, but also fueled the nation’s economic boom for more than a decade. But the system also took an enormous economic toll on personal pocketbooks.

所有这些措施形成了现在被称为国家资本主义的、政府控制下的市场体系。这些措施十分有效,不仅帮助中国行将破产的银行和国有企业死而复生,还推动了中国经济十多年的快速增长。但是,这个体系也让国民个人付出了巨大的经济代价。

“We’d like to spend, but we really have nothing left over after paying the bills,” said Yang Yang, 34, a school administrator who lives in Jilin City with her husband, a police officer, and their son, 10. “Even though our son goes to a public school, we need to pay fees for after-school courses, which everyone is expected to take. Almost every family will do this. So there’s a lot of pressure on us to do it, too.” To save money, Ms. Yang, her husband and son recently moved in with her parents.

“我们也想花钱,但是在交完各种费用之后,我们真的已经所剩无几了,”34岁的杨阳(音)说。她是一所学校的行政人员,和当警察的丈夫,还有10岁的儿子住在吉林市。“虽然我们的孩子上的是公立学校,我们仍需要支付课外补习班的费用,每个孩子都要上补习班。几乎每个家庭都会这么做。所以我们必须这样做的压力也很大。”为了省钱,杨阳一家三口最近搬去和她的父母同住。

Nicholas R. Lardy, an economist at the Peterson Institute for International Economics in Washington, calculates that the government policies exacted a hidden tax on Chinese households that amounted to about $36 billion in 2008 alone — or about 4 percent of China’s gross domestic product. Over the last decade, Mr. Lardy says, that figure probably amounted to hundreds of billions of dollars — money that banks essentially took from consumers’ hands.

据位于首都华盛顿的彼得森国际经济研究所(Peterson Institute for International Economics)的经济学家尼古拉斯·R·拉迪(Nicholas R. Lardy)计算,仅2008年一年,政府政策的结果相当于向中国普通家庭征收了高达相当于360亿美元的隐性税,大约是中国国内生产总值的4%。拉迪说,过去十年间的隐性税总量也许高达数千亿美元,这些钱实际上是银行从消费者手中拿走的。

The distortions may have actually cost households far more, because his figures do not include hidden costs like artificially high prices for imports.

实际上,这些扭曲的政策所造成的普通家庭花销可能更高,因为拉迪的计算中还没有考虑人为抬高进口商品价格这类的隐形成本。

For many Chinese economists, the state capitalism that helped jump-start growth has become counterproductive.

很多中国经济学家认为,这种促进了经济腾飞的国家资本主义模式已经开始产生相反的结果。

“China is already beyond the point where the law of diminishing returns starts biting,” said Xu Xiaonian, an economist who teaches at the China Europe International Business School in Shanghai.

位于上海的中欧国际工商学院的经济学家许小年说,“中国早已进入收益递减规律效应明显的阶段。”

Mr. Xu argues that China risks repeating the mistakes Japan made in the 1980s and early 1990s, when it relied too long on a predominantly export economy, neglected domestic markets and allowed real estate prices to soar. Since Japan’s bubble burst in the mid-1990s, its economy has never really recovered.

许小年认为,中国有重复日本在20世纪80年代和90年代初所犯的错误的危险。当时,日本过久地依赖于出口为主的经济增长方式,忽视了国内市场,并且允许房价飙升。自从20世纪90年代中期经济泡沫破裂以来,日本经济从未曾真正恢复元气。

“If we don’t change, we will follow those same footsteps,” Mr. Xu said. “We have already seen the early signs of what we might call the Japanese disease. China invests more and more, but those investments generate less and less growth.”

“如果我们不改革的话,就会步日本的后尘,”许小年说。“我们已经看到了所谓的日本病的早期迹象。中国投资的规模越来越大,但是投资所带来的增长却越来越少。”

PREDICTIONS FOR CHANGE:A Radical Overhaul,But Within Reach

对变化的预测:激进彻底的改革,但却触手可及

Some economists predict major changes, noting that the Chinese government has the cash and the power to alter course as drastically as it did in the late ’90s, this time in the people’s favor.

一些经济学家预测将会有重大变化出现。他们指出,中国政府有财力,也有能力对中国的发展道路做出大调整,就像90年代末期那样。但这一次,会对人民有利。

“China has faced more daunting challenges in the past,” said Wei Shangjin, a professor at the Columbia Business School. “I don’t doubt that they want to do it. The question is, Can they successfully engineer such a major restructuring of the economy?”

“过去,中国曾面临更严峻挑战,” 哥伦比亚大学商学院(Columbia Business School)教授魏尚进说。“我并不怀疑他们想改革。问题是,他们能够成功策划一个规模如此巨大的经济结构调整吗?”

Certainly, multinationals like McDonald’s, Nike and Procter & Gamble are still betting billions of dollars that China will grow into the world’s biggest consumer market within a few decades.

当然,像麦当劳、耐克和宝洁(Procter & Gamble)这样的跨国公司扔在投入几十亿美元的赌注,认为中国将会在近几十年内成为世界上最大的消费市场。

But raising consumption will require a radical overhaul of the Chinese economy — not just weaning state banks off household subsidies but forcing state-run firms to pay much higher borrowing rates. It would also mean letting the currency rise closer to whatever value it might naturally reach. It would mean, in other words, a significant dismantling of the state capitalism that has enabled China to come so far so fast. “To get consumption to surge,” said Mr. Pettis, the Peking University lecturer, “you need to stop taking money from the household sector.”

然而,增长消费必然要求中国对经济进行大刀阔斧的改革——不仅需要让国有银行摆脱对吮吸普通家庭积累的依赖,还要强制国有企业付出更高的借款利率。这也意味着,要让人民币上升达到其自然价值。换句话说,这意味着,要彻底打破当前让中国发展如此迅速的国家资本主义模式。北京大学教授佩蒂斯说,“为了让消费快速地增加,你必须停止从普通家庭的口袋里掏钱。”

Xu Yan contributed research.

本文最初发表于2011年10月9日。

Xu Yan对此文有研究贡献。

翻译:陈柳

爱华网

爱华网