《美国货币史(1867-1960)》最后一章回顾近百年货币史,得出四点结论(p.676):

1. Changes in the behavior of the money stock have been closelyassociated with changes in economic activity, money income, andprices.

2. The interrelation between monetary and economic change has beenhighly stable.

3. Monetary changes have often had an independent origin; they havenot been simply a reflection of changes in economicactivity.

4. (Less specific) Inmonetary matters, appearances are deceiving; the importantrelationships are often precisely the reverse of those that strikethe eye.

白话之,1. ΔM与ΔY、ΔP等实体经济变化关系密切;2. 这种关系是高度稳定的;3. ΔM通常是自变量,“ΔM←ΔY”只是这种关系的一方面;4. 人们经常颠倒理解了货币现象背后的作用机制。

1.

就第1点结论,Friedman和Schwartz列举了:

(1)1914-20和1939-48两次世界大战及战后期间:价格平均上涨1倍以上,同期货币存量亦上涨1倍以上;1897-1914:价格上涨40~50%,和平时期唯一的长期持续上涨,同期货币存量年均增速亦高于其他和平时期;

(2)1882-92,1903-13,1923-29,1948-60:四次经济高度稳定时期,货币存量年际变化也是稳定的;

(3)1873-79,1893-94(97),1907-08,1920-21,1929-33,1937-38:六次经济严重衰退期间,货币存量亦明显且绝对水平下降——其他衰退时期货币存量只是相对增速减缓,除了1948-49和1959-60两次绝对水平较小的下降。

总结道:(1)货币存量与货币收入、价格在周期和长期变动中都紧密相关:“Of relationships revealed by ourevidence, the closest are between, on the one hand, secular andcyclical movements in the stock of money and, on the other,corresponding movements in money income andprices.”(2)而货币存量与实际收入之间的密切关系只存在于cyclical movement中;“The relation between secularmovements in the money stock and in real income is much lessclose.”长期中,稳定的实际收入增速和货币存量增长比率是不相关的。

2.

就第2点结论,货币与其他经济变量(主要是Y和P)之间关系的高度稳定性,Friedman和Schwartz首先借百年英美两国汇率调整后的相对价格的稳定性例证“the stability of basic economicrelations”,还特意强调了“In the 79 years from 1871 to 1949,vast changes occurred in the economic structure and development ofthe United States, the place of Britain in the world economy, theinternal monetary structures of both the United States and Britain,and the international monetary arrangements linkingthem.”尚需说明货币的变革并未带来两国货币增长的紊乱。

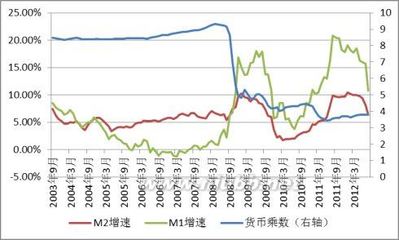

然后,作者以货币流通速度例证“the stability of basic monetaryrelations”[1]。“Velocity has shown a systematic andstable movement about its trend, rising during expansion andfalling during contraction.”但是,Friedman和Schwartz强调的只是货币流通速度变化的稳定性,而非货币流通速度本身的稳定性。根据费雪方程式MV=Py(=Y),要说明M与P、Y之间的稳定关系,V必须保证稳定或为常数。“the change occurred rathersteadily”其变化趋势再稳定也不能掩盖“the numerical value of velocitytherefore changed considerably”变化巨大更重要的事实:“During the nine decades ending in1960, the velocity of money fell by an average of slightly over 1per cent a year.”这说明长期中,M与Y(或P)之间的关系并非稳定,而是呈趋势性变化,尽管趋势比较稳定。“During business expansions it eitherrose or declined at less than this rate; during contractions itdeclined at more than this rate. The amplitudes of the cyclical rise andfall tended to vary with the amplitude of the cyclical movements ineconomic activity.”在周期变化中,这种稳定关系要因货币流通速度的同步变化而动荡益深(尽管大多数年份货币流通速度年际变化幅度小于10%):经济扩张时,Y因V增长(或较小减少)而较M原稳定比例关系更多增长;经济衰退时,Y因V较趋势更大幅下降而比M较原稳定比例下降幅度更大,例如大萧条时期美国货币存量下降33%,货币流通速度亦下降29%,进而加剧了国民生产净值下降幅度(53%)。概言之,货币流通速度这一指标,恰恰反映了M与Y(或P)关系的不稳定性。

其后,二位作者又考察了周期变化中货币存量与经济变量间的关系作为第三个例证。“On the average, the stock of money rose ata higher rate than money income; this is the other side of thesecular decline in velocity.”至于周期变化,同样只是货币流通速度的另一面而已:“The rise was more rapid than usualduring cyclical expansions and less rapid than usual duringcyclical contractions.”[2]

本节其余部分额外论述了“These uniformities have persisted despiteradical changes in monetary arrangements.”随着1933年黄金退出流通,货币独立性将得到加强。而“The inception of federal insurance ofbank deposits in 1934 finally changed decisively the behavior ofthe deposit-currency ratio.”

3.

就第3点结论,货币的相对独立性和M对Y的影响,Friedman和Schwartz举例:

(1)1897-1914的货币扩张,反映的是黄金产量的增加,且不能被归为现时货币收入与价格上升的结果。原因是:货币收入和价格的上升将导致世界黄金产量的普遍下降以及黄金流出。按此逻辑推理,只要是在金本位制下,货币收入和价格的上升就只能是货币扩张(黄金增加)的结果。事实上,这段时期货币存量年增长7.5%只带来2%的价格上涨,其余则被实际产出增加(>3%)和货币流通速度下降(<-2.5%)所抵消[3]。也就是说,M对Y(或P)的影响要打上很多折扣,而此时M与Y之间的“稳定”关系也会一改货币扩张前。

(2)一战和二战期间的货币存量上升:1)早期阶段,反映的是购买战争物资的黄金流入。作者以黄金的较早流入,而否认是当下经济的反映关系:“The inflows of gold were notby-products of contemporary changes in economic activity in thiscountry or abroad, as gold flows had been in the years before1914.”同时承认:“They were a consequence of theoutbreak of the two wars and the deliberate policy decisions of thepolitical authorities in the countries at war.”与其说货币存量独立于当下经济,不如说货币存量只是战争影响经济层面的传导中介——货币仍是“绳子”,但不是绳子的施动者[4];2)战争后期阶段,反映的是美国当局为战争开支融资。虽然“...involved a major expansion inhigh-powered money which continued the work begun by goldinflows”,但货币本身还不是“an independentorigin”[5],依然是手段而已,归结为凯恩斯视角下新创造的“需求”更合适。

(3)1870's恢复铸币支付和1890's银币自由铸造时期“display a substantial independence inthe monetary changes that occurred and also a rather complex actionand interaction between monetary and businesschanges.”作者重复的依然是上述例子的老调调:“Both were in some measure independentof the contemporary course of economic activity, though not ofcourse of longer-run economic developments.”

(4)联邦储备体系的建立后所逐渐给予货币作为施动者的独立性才是真正独立于实体经济的:“the establishment of the System gavea small body of individuals the power, which they exercised fromtime to time, to alter the course of events in significant andidentifiable ways through a deliberative process--a sequenceparallel with the conduct of a controlledexperiment.”其中三次重要实验分别是:1920年1-6月,1931年10月,1936年7月-1937年1月(表1)。

表1三次紧缩性货币政策实验

时期 | 货币政策 | 货币存量变动 | 工业产值变动 |

1920.1-6 | 再贴现率4.75%提高至6%,再至7% | 几个月后1年内由正转-9% | -30% |

1931.10 | 再贴现率1.5%提至3.5% | -14%,略深之前 | -24% |

1936.7-37.1 | 法定准备金翻倍 | 几个月后1年内由正转-3% | -34% |

除了紧缩性货币政策外,作者在脚注中也列举了三次扩张性货币政策的实验(表2):

表2三次扩张性货币政策实验

时期 | 货币政策 | 货币存量变动 | 工业产值变动 |

1923.12-24.10 | 联储购买$5亿政府债券 | 19%(1924.2-25.2) | 22.5%(1924.7-25.7) |

1932.4-8 | 联储购买$10亿政府债券 | 年率-14%转为1.75%(1932.4-33.1) | 14%(1932.7-11) |

1958.3-12 | 联储购买$30亿政府债券;增加$46亿联储信贷 | 6.6%(1957.12-58.12)附:4.9%(1958.3-12) | 23%(1958.4-1959.4) |

相对紧缩性货币政策而言,扩张性货币政策的效果要不明显一些(尤其是1958年的那次操作):“We regard these episodes as lessstriking and decisive than the three cited in the text, because theassociated monetary and economic changes are less distinctive:e.g., from June 1933 to June 1936, there was no Federal Reserveaction, yet the stock of money rose by 44 percent and industrialproduction by 31 percent.”作者谨慎将其放入脚注也是源于此。这似乎也佐证了那句名言:“you can pull on it but you can't pushon it.”

(5)大萧条时期货币与经济变化的关系,也被颠覆传统理解的作者用来例证:“The presumption that the economicchanges were the consequence of the monetary changes is greatlystrengthened by examination of the one sharp economic contractionnot associated with explicit restrictive measures by the FederalReserve System-the 1929 to 1931 contraction, which was the firstpart of the great contraction from 1929 to 1933.”尽管“That contraction has served perhapsmore than any other experience to strengthen the view that moneydances to the tune of business.”单从逻辑上言,美联储如采取紧缩政策而非不作为,“an influence running from money toincome”才比较说得通。而作者唯一提到的是1931年10月那次紧缩措施:“the assignment of priority to themaintenance of the gold standard was in a proximate sense thereason for the sharp rise in discount rates in October 1931following Britain's departure from gold and a gold outflow from theUnited State.”事实上,如作者所言,那次紧缩的相对效果其实比较温和[6]。随后的两条论证则一改事实性例证,而是这样想象中的扩张性货币政策效果:1)“...if Benjamin Strong could "have had twelvemonths more of vigorous health, we might have ended the depressionin 1930, and with this the long drawn out world crisis that soprofoundly affected the ensuing politicaldevelopments."”;“At all times throughout the 1929-33contraction, alternative policies were available to the System bywhich it could have kept the stock of money from falling, andindeed could have increased it at almost any desiredrate.”2)“...if the pre-1914 banking system rather thanthe Federal Reserve System had been in existence in 1929, the moneystock almost certainly would not have undergone a declinecomparable to the one that occurred.”;“...the experience of 1907 stronglysuggests that there would have been a more severe initial reactionto the bank failures than there was in 1930, probably involvingconcerted restriction by banks of the convertibility of depositsinto currency. The restriction might have had more severe initialeffects toward deepening the economic contraction than thepersistent pressure on the banking system that characterized late1930 and early 1931 had. But it also would have cut short thespread of the crisis, would have prevented cumulation of bankfailures, and would have made possible, as it did in 1908, economicrecovery after a few months.”

(6)Friedman和Schwartz随后还利用货币与经济关系的稳定性与货币安排的变动性,反证“from money tobusiness”的影响机制:“The existence of an importantindependent influence running from money to income explains thecontrast we have noted between the variability in monetaryarrangements during the near-century we have studied and thestability of the relation between changes in money and in othereconomic variables.”其理由是:若影响机制是“from business tomoney”,那么在不同的货币安排下,经济变动将对货币存量带来不同影响,也即货币与经济关系的稳定性将改变。其例证是:1)Pre-1914金本位制下,经济扩张Y↑→国际收支逆差→黄金外流→M↓;此联系或为1920's美联储、1930's财政部的黄金对冲政策(gold-sterilizationpolicy)“was largelysevered”,或为其后金本位动摇“was greatlyweakened”。此种“Y↑→M↓”联系,如同本结论部分例证(1)逻辑,其实不是反映上述“货币与经济稳定关系”的逻辑。Y↑若主要表现为实际收入y↑,只要不引致P↑高于外国,黄金就不会外流,M不一定↓,相反,M按稳定比例关系↑。如1873年绿钞主义和1890's银币自由铸造反映的正是这种“Y↑→M↑”诉求。2)Pre-1914,Y↑→i↑→存款-准备金比率↑或资本、黄金流入→M↑;Post-1914,Y↑→i↑→增加银行从Fed更多借款渠道→M↑。事实上,如若货币需求来自真实经济需求,则M↑自然会适应Y↑,而渠道变化的本身很大程度上也正是Y↑对M↑的反映,比如金本位制在国际货币体系中的逐步动摇到最终瓦解。总之,没有理由认为“a change in business would have haddifferent effects on the stock of money under the differentmonetary arrangements.”至于“from money tobusiness”的影响机制下,作者亦承认“货币安排的变化→ΔM”:“The variability of monetaryarrangements has produced, as we have seen, a correspondingvariation in the movements of money itself.”也即货币安排的变化也最终导致了相应的经济变化,才能使M与Y关系继续稳定下去。而作者则相信M→Y的渠道机制没有变化,因而会传导下去:“That relation is determined primarilyby the channels through which money affects business.So long as they remain the same, asapparently they have, so also should the relation between money andbusiness.”因而,比较“from business tomoney”与“from money tobusiness”两者的实证检验在于,前者Y→M,也即Y、M不因货币安排的变化而有变化;后者M→Y:货币安排的变化→ΔM→ΔY。上述第2点结论部分首例两国相对价格稳定性不因货币安排的变化而变化即已说明谁是谁非[7]。

(7)就二者的相互作用而言,Friedman和Schwartz亦承认短期商业周期变动中的Y→M影响机制:“While the influence running frommoney to economic activity has been predominant, there have clearlyalso been influences running the other way, particularly during theshorter-run movements associated with the businesscycle.”并以存款-准备金比率的周期模式为例:“The resumption and silver episodes,the 1919 inflation, and the 1929-33 contraction reveal clearlyother aspects of the reflex influence of business onmoney.”当然此时M反过来也会对Y产生进一步影响,Y→M→Y:“Changes in the money stock aretherefore a consequence as well as an independent source of changein money income and prices, though, once they occur, they producein their turn still further effects on income andprices.”但Y→M在长期中便难与M→Y平分秋色了:“Mutual interaction, but with moneyrather clearly the senior partner in longer-run movements and inmajor cyclical movements, and more nearly an equal partner withmoney income and prices in shorter-run and mildermovements.”M→Y之间的“channels”,借用MB—M分析工具,即高能货币、存款-准备金比率和存款-通货比率。M→Y,更多是通过高能货币变量作用,从MB→M→Y,在push on时,往往要经受两个存款比率下降以及货币流通速度下降的两层折扣,而这本身就是Y对M→Y时的反作用,无情示现天道自然法则面前不知敬畏人类的渺小。

4.

就第4点结论,货币表象的欺骗性,言简摄广,故单择要归纳如下:

(1)南北战争期间,黄金美元价格波动,表象上是受战争局势影响,实际上战争局势的影响很小,波动更多反映的是棉花出口急剧下降与北方发行货币引致的国内价格上升。

(2)为恢复铸币支付成功原因,并非是从国外购买黄金(帮倒忙)等政府措施,而是政府的the acts of omission andcommission促进了产出迅速增长,使价格水平下降了一半。

(3)银币自由铸造(free silver)运动失败,并不是“稳健货币论”(“sound money”)的胜利,前者政治上失败原因是黄金发现及黄金采冶技术进步,made gold the effective vehicle forthe inflation that Bryan and his followers had sought to achievewith silver.

(4)1907年银行业危机,迫使银行业改革,然而银行限制存款兑换现金措施中止了这场流动性危机。

(5)联储体系建立目的是为防止恐慌与兑换限制和促进货币稳定,事实上它没能阻止美国经济史上最严重的恐慌、兑换限制与银行体系崩溃,带来了30年的更大的货币不稳定。

(6)股市繁荣与一战通胀使人们普遍相信1920's是通胀期,大萧条是其反应。事实上,20年代是相对紧缩时期:批发物价年均-1%,货币年均4%。

(7)1929-33货币崩溃并非是前期不可避免的结果,而是政策的结果,其他可选政策本可阻止这场崩溃;联储声称是easy-money policy,其实是exceedingly tightpolicy。

(8)罗斯福新政支持者偏好宽松货币,但later 30s的货币快速扩张主要原因却是:黄金价格上升和希特勒上台刺激资本流入美国。除黄金价格上升,快速扩张与monetary actions无关。其他黄金国有化、黄金条款取消与新政计划抑制商业投资作用相反;联储1936-37法定准备金翻倍,“precautionary”措施,serious deflationaryimpact。

(9)1930's白银购买计划表面上是为提高白银在国家货币储备中比重:1/6 to 1/3。很大部分是为援助白银矿工,1/3比例从未实现。(But the silver-purchase program inthe thirties did impose several years of drastic deflation onChina, drove China permanently and Mexico temporarily off thesilver standard.)

(10)人们广泛预期伴随二战其后的是严重失业。联储亦有所备并欢迎债券支持计划(认为与宽松货币政策一致)。结果,通胀迫近成为更大威胁,朝鲜战争进一步推动了通胀。联储最终被迫放弃债券支持计划。

(11)国内外普遍认为,货币经济作用很小,除非当总需求不足时,货币量使长期利率水平降低,might contribute a miteto总需求。Easy money was the near-uniformprescription. Inflation was the near-uniform result.一个教训是:恢复了对货币在经济事务中角色的合理重视。

(12)异于长期趋势的战后货币流通速度上升,很大程度上可看作是对战时下降的修复,但上升之高之久已很难再单用此因素解释。诸多解释有:货币替代物的更广泛可得性与更好品质,利率的上升,恐惧通胀。作者解释:公众普遍对经济稳定的信心增强,预期长期下降亦将恢复。But we are still too close to theappearances to be at all sure in what way they aredeceptive.

(13)(跳出具体历史分析,回到本部分开篇一般):Money is a veil.如John S. Mill在Principles of Political Economy(1848)中所说——

There cannot, in short, be intrinsically a more insignificantthing, in the economy of society, than money; except in thecharacter of a contrivance for sparing time and labour. It is amachine for doing quickly and commodiously, what would be done,though less quickly and commodiously, without it: and like manyother kinds of machinery, it only exerts a distinct andindependent influence of its own when it gets out oforder.

然而,亦有误导,除非我们意识到:there is hardly a contrivance man possesses whichcan do more damage to a society when it goesamiss.

_________________________

[1] “The velocity of money, which reflects themoney-holding propensities of the community, offers another example of the stabilityof basic monetary relations.”可见,作者是将上一例证“the stability of basic economicrelations”等同于“the stability of basic monetaryrelations”的。

[2] “The rate of rise tended to slow down well before thepeak in business and to speed up well before thetrough.”则只不过是张晴雨表,更谈不上是反映了货币存量与货币收入之间关系的稳定性。

[3] “Of the 7.5 percent per year increase in the stock ofmoney, price rises, as we have seen, absorbed some 2 percent peryear. Something over 3 per cent was absorbed by a growth in thereal output of goods and services, something under 2.5 percent by adecline in the velocity of money-that is, a rise in money balancesrelative to income.”(p.138)

[4] “Monetary policy is like a string; you canpull on it but you can't push on it.”(p.348)此处“绳子”的寓意有货币是施动者,而非简单中介的含义。

[5] 见结论3:“Monetary changes have often had an independentorigin;...”感觉Friedman和Schwartz还是把货币“有其独立源”和“本身是独立源”二者混淆了,所以其例证中常常犯这样的错误,尽管他们真实要说明的货币独立性含义是后者。货币有独立源,往往并非独立于实体经济的,这和Friedman和Schwartz的“美联储购买政府债券”典型政策结论中所给予货币的独立性是截然不同的。

[6] “The 1931 decline--the severest absolute decline of thethree--was the mildest in terms of deceleration; the money stock inthe preceding year had been falling at a slightly lower rate, sothe increase in the rate of decline in the year beginning October1931 was only about one percentage point.”(p.689)

[7] “In the 79 years from 1871 to 1949, vastchanges occurred in the economic structure and development of theUnited States, the place of Britain in the world economy, theinternal monetary structures of both the United States and Britain,and the international monetary arrangements linking them. Yet,despite these changes, despite two world wars, and despite thestatistical errors in the price-index numbers, the adjusted priceratio expressed on a base which makes 1929 = 100 was between 84 and111 in all but one of the 79 years.”(p.679)

爱华网

爱华网