International Trade 国际贸易

Section 1 What is InternationalTrade? 什么是国际贸易?

International trade refers to the transactions that take placebetween the sellers from one country and the buyers from another.From the perspectives of one country, international trade is alsocalled “foreign trade”. International trade is the branch ofeconomics concerned with the exchange of goods and services withforeign countries. International trade can also be understood asexport and import goods of technology or services. In fact, ininternational trade, tangible goods account for the mostpercentage. The purchase and sales of goods are called “visibletrade” as well. In the same way, the purchase and sales of servicesand technology are called “invisible trade”, as the subject matterconcerned is not tangible goods. Visible trade is trade in goodswhich can be actually seen passing through ports or airports,entering or leaving one country. Invisible trade is trade inservices and technology. The services in question include suchitems as transport, banking, tourism, insurance and education. Asfor technology, it is more closely concerned with visible trade.For example, if an American corporation would need to makeavailable to China all the technological knowledge required toproduce that product, which is a tangible product. The sum theChinese manufacturer paid for use of this know-how would beinvisible item of trade.

Trade in goods and services is one of the means by which a countryis linked to another in economy. Countries that have mutualinternational trade relationship need the goods or services fromeach other. They are dependent on one another in some way. Oneparty in a country needs something and is willing to buy while theother party in another party has the goods and is likewise willingto sell the goods. Either party gets its own benefits. It is awin-win deal.

Further, the term “international trade” is broadly defined astransactions between sovereign nations which include the purchaseand sale of consumer services such as travel, industrial rawmaterials and services, producer and capital goods such as plantand machinery, securities in the form of promissory notes andstock-ownership certificates, and natural resources such as crudeoil, gold and other minerals.

International trade has developed greatly under the influence ofinternational agreements that began in 1944 at the Bretton WoodsConference. The agreements recognized that all nations, no matterwhat their economic organization may be, must trade if they hope toget economically powerful. Some countries have raw materials thatothers do not have; some countries have favorable climates toparticular crops while other countries do not have. For thisreason, international trade becomes inevitable.

- international trade 国际贸易

- foreign trade 对外贸易

- visible trade 有形贸易

- invisible trade 无形贸易

- tangible product 有形产品

- know-how 技术

- a win-win deal 双赢交易

- sovereign nation 主权国家

- industrial raw material 工业原材料

- stock-ownership certificate 证券所有权证明

Section 2 Reasons for International Trade国际贸易的理由

- Resource Reasons

The uneven distribution of resources around the world is one ofthe basic reasons why nations began and continue to trade with eachother.

(1) Favorable Climatic Conditions and Terrain

Climatic conditions and terrain are very important for agriculturalproduces. The difference in these factors enables some countries togrow certain plants and leaves other countries with the only choiceto import the produces they consume. For example, Colombia andBrazil have the opportunity to export coffee beans to countriesworldwide. Another example is that the US Great Plains states havethe ideal climate and terrain for raising wheat. This has made theUS a big wheat exporter.

(2) Natural Resources

Some countries are the major suppliers of certain natural resourcesbecause the distribution of natural resources around the world issomewhat haphazard. The Middle East, for instance, has rich oilreserves and is the main source of oil supply to the world. It hasover 50% of the world total reserves and produces about 40% of theworld output. Over 2/3 of the oil that West Europe and Japan needis imported from Middle East and the US oil military consumption inEurope and Asia is largely purchased from that area.

(3) Skilled Workers

The Japan and Western European countries have skilled workers whoare able to manufacture sophisticated equipment and machinery suchas jet aircrafts and computers, etc. Other countries, since theydon’t have well-trained engineers and workers, must import theequipment from these countries.

(4) Capital Resources

Developing countries need to modernize their industries andeconomies with advanced machinery, equipment and plant that theyare not yet able to manufacture because of the lack of capital.This has given rise to the need for developing internationaltrade.

(5) Favorable Geographic Location and Transport Costs

There are many examples that countries have developed closeeconomic relationship chiefly because they are geographically closeto each other. Sino-Japanese trade relationship is to some degreedetermined by geographic proximity and low transport cost. The USand Canada have a very close trade relationship for similarreasons. EU can be another example.

(6) Insufficient Production

Some countries cannot produce enough items they need. The UK, forinstance, does not have a large enough agricultural population. Infact, only 5% of its population is engaged in agriculture and theymainly grow fruits and flowers. The UK then has to import 60% ofits total agricultural consumption. Developing countries normallydo not have enough manufactured goods as they need and thereforehave to import them.

2. Economic Reasons

In addition to getting the products they need, countries also wantto gain economically by trading with each other. It is madepossible by varied prices for the same commodity around the world,reflecting the differences in the cost of production.

(1) Absolute Advantage—by Adam Smith in The Wealth of Nations(1776)

Smith assumed that each country could produce one or morecommodities at a lower real cost than its trading partners. It thenfollows that each country will benefit from specialization in thosecommodities in which it has an “absolute advantage,” (ie. beingable to produce at a lower real cost than another country),exporting them and importing other commodities which it produces ata higher real cost than does another country.

Absolute-Cost Example

Country | Days of Labor Required to Produce | |

Cloth (1 bolt) | Wine (1 barrel) | |

Scotland | 30 | 120 |

Italy | 100 | 20 |

From this example, we can see clearly that Scotland shouldspecialize in the production of cloth on which it has a costadvantage. Instead of spending 120 days of labor to produce abarrel of wine, Scotland should import wine from Italy. Similarly,Italy should concentrate on the production of wine and import clothfrom Scotland.

(2) Comparative Advantage—by David Ricardo in Principles ofPolitical Economy and Taxation (1871)

Ricardo showed that absolute cost advantages are not a necessarycondition for two nations to gain from trade with each other.Instead, trade will benefit both nations provided only that theirrelative costs, that is, the ratios of their costs, are differentfor two or more commodities. In short , trade depends ondifferences in comparative cost, and one nation can profitablytrade with another even though its real costs are higher (or lower)in every commodity.

A country has a comparative advantage if it can make a productrelatively more cheaply than other countries. A country should makethe product that yields the greatest advantage or the leastcomparative disadvantage.

This theory is the basis of specialization and trade.

Comparative-Cost Example

Country | Total Output | Ratio of Costs | |

Rice | Copper | ||

A | 2 | 4 | 1R:2C or 1/2 R:1C |

B | 1 | 1 | 1R:1C |

Assume that the costs of production are the same for bothproducts in both countries, but, as we have seen, the price of oneproduct in terms of the other or the comparative costs of rice andcopper are different in A and B. In such a case, there should be again for both countries if thy trade with each other. Let’s seehow.

Suppose Country A concentrates on producing copper and Country B onrice. Then they can produce eight units of copper and two units ofrice respectively. Further assume that they will use half of theiroutput to exchange for the other commodity they need but don’tproduce. If we look at the costs of each country, it seems both ofthem, as the following diagram shows, can get twice as much as theycan produce themselves.

Country | Quantity Owned After Trading | Exchange Rates Used | |

Rice | Copper | ||

A | (4) | 4 | 1R:1C |

B | 1 | (2) | 1R:2C or 1/2 R:1C |

But a second look reveals that the transaction cannot beconcluded since these two countries are using two different ratesof exchange. It is like that a buyer wants to pay $50 for a watchwhile the seller asks for $100. However, the trade can still bemeaningful as long as the following is achieved.

Country | Quantity Owned After Trading | |

Rice | Copper | |

A | 2<X<4 | 4 |

B | 1 | 1<Y<2 |

And in order to conclude the deal, there should be one commonrate: X/4=1/Y or XY=4.

If X=3, then Y=1.33 (+0.33).

If Y=1.5, then X=2.67 (+0.67).

In both cases, either A or B has gained by trading with the otherparty.

3. Political Reasons

Political objectives can sometimes outweigh economic considerationsbetween countries. One country might trade with another country inorder to support the latter’s government which upholds the samepolitical doctrine. Or trade with some countries is banned orrestricted just not to benefit a government with politicaldisagreements.

- agricultural produce 农产品

- natural resources 自然资源

- capital resources 资本资源

- geographic proximity 地理上接近

- absolute advantage 绝对优势

- absolute cost 绝对成本

- cost advantage 成本优势

- comparative advantage 比较优势

- comparative cost 比较成本

- rates of exchange 汇率

Section 3 Contribution of Trade to Development贸易对发展的贡献

There are many ways in which international trade can contribute tothe economic development of today’s developing nations. Oneeconomist has pointed out the following important beneficialeffects that international trade has on economic development.

1. Trade can lead to the full utilization of underemployed domesticresources. That is, through trade, a developing nation can movefrom an inefficient production point inside its productionfrontier, with unutilized resources because of insufficientinternal demand, to a point on its production frontier with trade.For such a nation, trade would represent a vent for surplus or anoutlet for its potential surplus of agricultural commodities andraw materials. This has indeed occurred in many developing nations,particularly those in Southeast Asia and West Africa.

2. By expanding the size of the market, trade makes possibledivision of labor and economies of scale. This is especiallyimportant and has actually taken place in the production of lightmanufacturers in such small economic units as Taiwan, Hong Kong,and Singapore.

3. International trade is the vehicle for the transmission of newideas, new technology, and new managerial and other skills.

4. Trade also stimulates and facilitates the international flow ofcapital from developed to developing nations. In the case of directforeign investment, where the foreign firm retains managerialcontrol over its investment, the foreign capital is likely to beaccompanied by foreign skilled personnel to operate it.

5. In several large developing nations, such as Brazil and India,the importation of new manufactured products has stimulateddomestic demand until efficient domestic production of these goodsbecame feasible.

6. International trade is an excellent antimonopoly weapon becauseit stimulates greater efficiency by domestic producers to meetforeign competition. This is particularly important to keep low thecost and price of intermediate or semi-finished products used asinputs in the domestic production of other commodities.

1. domestic resources 国内资源

2. production frontier 生产前沿

3. internal demand 国内需求

4. division of labor 劳动分工

5. economies of scale 规模经济

6. international flow of capital 资本的国际流通

7. intermediate product 中间产品

8. semi-finished product 半成品产品

Section 4 Benefits of International Trade国际贸易的益处

1. Cheaper Goods

For one thing, countries trade because there is a cost advantage.This has been explained in the section of “economic reason” forinternational trade. Further, competition in the world marketremains constant. This has made prices even lower. Last, if thequality of the imported goods is better but the price is not highercompared with the domestic cost, there is still a costadvantage.

2. Greater Variety When Goods Come from More Countries

Anyone who has experienced China’s economic development in the pastdecades can tell the changes in the variety of both capital goodsand consumer goods. These changes have not only improved thequality of our life but also increased the productivity of ourindustries.

3. Wider Market with Increasing Number of Trading Partners

International trade can greatly expand the market. The expansionenables manufacturers to take advantage of economies of scale inboth research and production. Besides, since markets around theworld are often in different development stages, newly expandedmarkets can help extend the life of products.

4. Growth of Economy

Foreign trade has become more and more important for many countriesas it creates jobs that both have economic and politicalsignificance. Thus, countries have attached increasing importanceto foreign trade, it is crucial for them to keep foreign tradegrowing to ensure the development of the economies.

- domestic cost 国内成本

- capital goods 资本货物

- consumer goods 消费品

- productivity 生产能力

- economic development stage 经济发展阶段

Section 5 Problems in the International Trade国际贸易中的问题

1. Trade Restrictions

Despite the benefits that all countries can receive frominternational trade, various kinds of restrictions on trade amongcountries are very common today.

(1) Reasons for Trade Restrictions

First, many country want a diversified economy to be less dependenton foreign countries both economically and politically.

Then, it is crucial for countries to protect their vitalindustries, which are closely related to stability and economicdevelopment. For instance, during 18th—19th centuries, Britain’sproduction cost of cotton products was greater than China’s andIndia’s, but Britain protected and continued its textile industry.Right after the Second World War, Japan’s cost of steel industrywas greater than that of the US. Now the US’s cost of steelproduction is higher than Japan’s. Yet neither of them has allowedfree competition in this crucial industry.

Thirdly, there is an infant industry argument which maintains thata new industry needs to be protected until the labor force istrained, the production techniques are mastered and the operationbecomes large enough to enjoy the economies of scale and to be ableto compete in the market. It is not fair to let an industry in itsinfant stage compete with a mature industry.

Furthermore, domestic jobs need to be protected from cheap foreignlabor, especially in labor-intensive industries such as textileindustry, since employment is crucial to a country’sstability.

Last, there are pure political reasons. There have been alwaysexamples that some countries refuse to do business with othercountries because of political reasons.

(2) Kinds of Restrictions

A tariff is a duty or fee levied on goods being imported into acountry. It can be a revenue tariff, which is collected mainly forincome purpose, or a protection tariff, which is collected in orderto protect the domestic market. However, it s sometimes difficultto distinguish the above two forms since both may have the functionof the other, i.e., a revenue tariff can also reduce the volume ofimports t protect domestic market and a protection tariff willprovide income for the government as well.

According to the time of collection, duties can be divided intoimport duty and export duty. Import duty is collected when goodsare imported, and export duty is collected when goods are exportedin order to control the export of anything with nationalimportance. Besides regular import duty, importers might have topay import surtax, too. Generally speaking, import surtax isadditional to import duty, is temporary in coping withinternational payment difficulties, maintaining balance of tradeand preventing dumping, and is discriminatory against a particularcountry.

Import surtax has three forms.

Countervailing duty is collected against bounty or grant duringproduction, transport and export, etc.

Anti-dumping duty is collected when importing country believes thatthere is a dumping(a not universally defined concept that can meanthe selling price in a foreign country is below domestic sellingprice, world market price or production cost).

Variable levy is collected at the difference between world marketprices and the support prices for domestic producers to make theimported commodities no more competitive in price than the domesticcommodities.

According to the methods in which tariffs are collected, there arefour types of duties. Specific duty is collected per physicalunit—according to weight, volume, measurement and quantity, etc. Advalorem duty is collected according to value of price, i.e., at apercentage of the price. Mixed or compound duty is collectedaccording to either specific duty of ad valorem duty first, thenthe other. An alternative duty is collected whichever the higherbetween specific duty and ad valorem duty.

The duties discussed above are not independent of each other, i.e.,a duty can be an import, a protective and a compound duty at thesame time.

2) Non-tariff barriers

In addition to tariffs, countries also use other methods to makeimport more difficult. These methods, collecting no tariffs, arecalled non-tariff barriers.

Quota

This is a quantitative restriction or upper limit in terms ofphysical quantity or value. This upper limit can be set on global(first come first served) basis or on country basis. An absolutequota is one that cannot be exceeded and a tariff quota is one thatrequires low or no duties below the limit but high duties orpenalty above the limit.

Import License

An import license is a permit for import, which can be independentor combined with quotas.

Foreign Exchange Control

This barrier intends to control import by limiting the access toforeign money that is needed for imports.

State Monopoly of Import and Export

With this form of barrier, import and export are restricted bygiving exclusive authorities of import and export to only a limitednumber of (state) companies.

Government Procurement Policy

This policy stipulates that governmental organizations must uselocal products unless some conditions are met. For instance, BuyAmerican Act 1993 says that the US government must buy Americanproducts unless the domestic price is on average 25% (from 6% to50%) higher than foreign prices. There are similar regulations inJapan.

Advanced Deposit

This barrier increases the cost of imports by forcing importers todeposit a percentage of the total value of the importers for aperiod of time without interest or with a very low interest.

Technical Standards

This is a method of import control that is widely used and heatedlyargued about. By using technical standards that foreign exportersare not familiar with or have difficulties to meet, the volume ofimport is controlled.

Health & Sanitary Regulations

These regulations can also discourage importers, especially whenthe regulations imposed by the importing country are different fromthat of the exporting country. Technologically, to meet therequirements of the regulations might not be easy at all.

Packaging and Labeling Regulations

These regulations represent still another barrier. Importingcountries can have sophisticated regulations regarding packagingand labeling in terms of sizes of letters, languages used andorders in which different languages are used. Such practices aremore commonly found in multi-cultural countries.

Minimum Price

Minimum price is the lowest price set by an importing country forimported goods. There could be a ban on imports or surtax onimports below the minimum price.

There are other forms of non-tariff barriers and countries arecontinuing to create more. For Example, one country can force ontoanother country through bilateral agreements at a low rate ofincrease in export volume or a country can set up new rules thatmake documentation much more complicated and difficult for itstrading partners.

2. Cultural Problems

There are two major cultural issues that contribute to the successof international trade: 1) language, including terms oftransaction; and 2) customs and manners. It in fact requiresseparate texts to address these two subjects. International tradersmust be constantly aware that cultural problems have reminded to bethe major obstacles in international trade and, therefore, everyeffort should be made to identify and solve such problems.

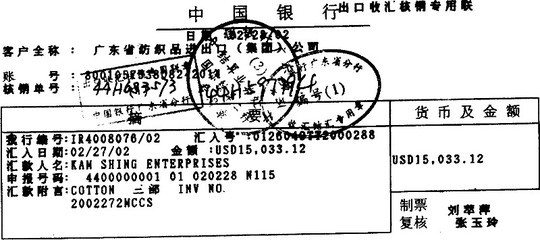

3. Monetary Conversion

Since different currencies are involved in international trade,conversion between currencies is inevitable. Yet it is no simple tojob to convert one currency into another without a loss whilealmost all currencies float every minute. The existence of exchangerisk represents a great challenge to all international traders andtrying to hedge against the risk has been the everyday job of manyprofessionals.

- infant industry 幼稚产业

- labor-intensive industry 劳动密集型产业

- tariff barrier 关税壁垒

- revenue tariff 财政关税

- protection tariff 保护关税

- import duty and export duty 进出口关税

- import surtax 进口附加税

- countervailing duty 反补贴税

- anti-dumping duty 反倾销税

- specific duty 从量税

- ad valorem duty 从价税

- mixed or compound duty 混合关税

- alternative duty 选择关税

- non-tariff barrier 非关税壁垒

- quota 配额

- import license 进口许可证

- foreign exchange control 外汇控制

- government procurement policy 政府采购

- minimum price 最低限价

- monetary conversion 货币兑换

爱华网

爱华网