年金现值就是在已知等额收付款金额未来本利(Future Value)、利率(interest)(这里我们默认为年利率)和计息期数n时,考虑货币时间价值,计算出的这些收付款到现在的等价票面金额Present Value。分为:普通年金(后付年金)、先付年金、递延年金、永续年金等几种。也可分为:普通年金现值、先付年金现值、递延年金现值、永续年金现值。

年金现值_年金现值 -分类

年金

年金(Annuity)是指一定期间内每期等额收付的款项。因此,可以说年金是复利的产物,是复利的一种特殊形式(等额收付)。普通年金

普通年金(OrdinaryAnnuity)是指每期期末收付款项的年金,例如采用直线法计提的单项固定资产的折旧(折旧总额会随着固定资产数量的变化而变化,不是年金,但就单项固定资产而言,其使用期内按直线法计提的折旧额是一定的)、一定期间的租金(租金不变期间)、每年员工的社会保险金(按月计算,每年7月1日到次年6月30日不变)、一定期间的贷款利息(即银行存贷款利率不变且存贷金额不变期间,如贷款金额在银行贷款利率不变期间有变化可以视为多笔年金)等。

先付年金

先付年金(AnnuityDue)是指每期期初收付款项的年金,例如先付钱后用餐的餐厅,每一道菜(包括米饭、面、饺子和馄饨等)分别出来之后都是先付年金。递延年金

递延年金(DeferredAnnuity)是指在预备计算时尚未发生收付,但未来一定会发生若干期等额收付的年金,一般是在金融理财和社保回馈方面会产生递延年金。递延年金在做投资或其他资本预算时具有相当可观的作用。永续年金

永续年金(PerpetualAnnuity)即无限期连续收付款的年金,最典型的就是诺贝尔奖金。年金现值_年金现值 -计算

现值点年金现值是年金终值的逆计算。

计算公式:

P=Afrac{1-(1+i)^{-n}}{i}

年金现值因子:frac{1-(1+i)^{-n}}{i},是普通年金1元、利率为i、n期的年金现值,记作(P/A,i,n)。

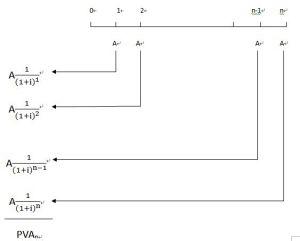

推导过程:P=A(1+i)^{-1}+A(1+i)^{-2}+cdots+A(1+i)^{-(n-1)}+A(1+i)^{-n}……………………①

将①式乘以(1+i),则:

(1+i)P=A(1+i)^0+A(1+i)^{-1}+dots+A(1+i)^{-(n-2)}+A(1+i)^{-(n-1)}………………………②

②-①,则:

(1+i)P?P=A-A(1+i)-n

P(1+i-1)=A[1-(1+i)-n]

∴P=Afrac{1-(1+i)^{-n}}{i}

P=Acdot(P/A,i,n)

年金现值_年金现值 -计算年金现值的举例

普通年金现值是指一定时期内每期期末收付款项复利现值之和。例1:要得到按6%折现、期数为3、每期为1元的普通年金的现值,

在第一期末收到1元的现值为0.943元,第二期末收到1元的现值为0.890元,第三期末收到到1元的现值为0.840。年金的现值就是各个现值的总和2.673元。

例2:租入某设备,每年年末需支付租金1200元,年复利率为10%,5年内应支付租金总额的现值是多少?(元)

解答:知道年金,求年金现值!

1200*年金现值系数=4549(元)

所以,4549元是1200元租金年金按利率为10%五年期的现值。

现实上,年金现值与年金是互为逆运算,若已知年金现值时,也可求得年金。

年金现值系数的倒数,也称资本回收系数,因为这个系数是计算资本回收额时使用的,而资本回收是指在给定期的年限内等额回收或清偿初投入的资本或所欠的债务,资本回收额的计算实际上是已知年金现值求年金的形式。

例:某企业以12%的年利率借款10万元,投资于某个寿命为10年的项目,每年至少要收回多少现金才是有利的?

解答:知道年金现值,求年金!

10万/年金现值系数=17700(元)

所以,17700元是10万元年金现值按利率12%十年期的年金,也是用10万元借款投资十年期项目在利率12%的情况下每年至少要收回的现金金额。

年金现值_年金现值 -年金现值系数表

n1%2%3%4%5%6%8%10%12%14%15%16%18%20%22%24%25%30%35%40%45%50%10.9900.9800.9700.9610.9520.9430.9250.9090.8920.8770.8690.8620.8470.8330.8190.8060.7990.7690.7400.7140.6890.66621.9701.9411.9131.8861.8591.8331.7831.7351.6901.6461.6251.6051.5651.5271.4911.4561.441.3601.2891.2241.1651.11132.9402.8832.8282.7752.7232.6732.5772.4862.4012.3212.2832.2452.1742.1062.0421.9811.9521.8161.6951.5881.4931.40743.9013.8073.7173.6293.5453.4653.3123.1693.0372.9132.8542.7982.6902.5882.4932.4042.3612.1661.9961.8491.7191.60454.8534.7134.5794.4514.3294.2123.9923.7903.6043.4333.3523.2743.1272.9902.8632.7452.6892.4352.2192.0351.8751.73665.7955.6015.4175.2425.0754.9174.6224.3554.1113.8883.7843.6843.4973.3253.1663.0202.9512.6422.3852.1671.9831.82476.7286.4716.2306.0025.7865.5825.2064.8684.5634.2884.1604.0383.8113.6043.4153.2423.1612.8022.5072.2622.0571.88287.6517.3257.0196.7326.4636.2095.7465.3344.9674.6384.4874.3434.0773.8373.6193.4213.3282.9242.5982.3302.1081.92198.5668.1627.7867.4357.1076.8016.2465.7595.3284.9464.7714.6064.3034.0303.7863.5653.4633.0192.6652.3782.1431.947109.4718.9828.5308.1107.7217.3606.7106.1445.6505.2165.0184.8334.4944.1923.9233.6813.5703.0912.7152.4132.1681.9651110.3679.7869.2528.7608.3067.8867.1386.4955.9375.4525.2335.0284.6564.3274.0353.7753.6563.1472.7512.4382.1841.9761211.25510.5759.9549.3858.8638.3837.5366.8136.1945.6605.4205.1974.7934.4394.1273.8513.7253.1902.7792.4552.1961.9841312.13311.34810.6349.9859.3938.8527.9037.1036.4235.8425.5835.3424.9094.5324.2023.9123.7803.2232.7992.4682.2041.9891413.00312.10611.29610.5639.8989.2948.2447.3666.6286.0025.7245.4675.0084.6104.2643.9613.8243.2482.8142.4772.2091.9931513.86512.84911.93711.11810.3799.7128.5597.6066.8106.1425.8475.5755.0914.6754.3154.0013.8593.2682.8252.4832.2131.9951614.71713.57712.56111.65210.83710.1058.8517.8236.9736.2655.9545.6685.1624.7294.3564.0333.8873.2832.8332.4882.2161.9961715.56214.29113.16612.16511.27410.4779.1218.0217.1196.3726.0475.7485.2224.7744.3904.0593.9093.2942.8392.4912.2181.9971816.39814.99213.75312.65911.68910.8279.3718.2017.2496.4676.1275.8175.2734.8124.4184.0793.9273.3032.8442.4942.2191.9981917.22615.67814.32313.13312.08511.1589.6038.3647.3656.5506.1985.8775.3164.8434.4414.0963.9423.3102.8472.4952.2201.9992018.04516.35114.87713.59012.46211.4699.8188.5137.4696.6236.2595.9285.3524.8694.4604.1103.9533.3152.8502.4972.2201.9992118.85617.01115.41514.02912.82111.76410.0168.6487.5626.6866.3125.9735.3834.8914.4754.1213.9633.3192.8512.4972.2211.9992219.66017.65815.93614.45113.16312.04110.2008.7717.6446.7426.3586.0115.4094.9094.4884.1293.9703.3222.8532.4982.2211.9992320.45518.29216.44314.85613.48812.30310.3718.8837.7186.7926.3986.0445.4324.9244.4984.1373.9763.3252.8542.4982.2211.9992421.24318.91316.93515.24613.79812.55010.5288.9847.7846.8356.4336.0725.4504.9374.5074.1423.9813.3272.8552.4992.2211.9992522.02319.52317.41315.62214.09312.78310.6749.0777.8436.8726.4646.0975.4664.9474.5134.1473.9843.3282.8552.4992.2221.9992622.79520.12117.87615.98214.37513.00310.8099.1607.8956.9066.4906.1185.4804.9564.5194.1513.9873.3292.8552.4992.2221.9992723.55920.70618.32716.32914.64313.21010.9359.2377.9426.9356.5136.1365.4914.9634.5244.1543.9903.3302.8562.4992.2221.9992824.31621.28118.76416.66314.89813.40611.0519.3067.9846.9606.5336.1525.5014.9694.5284.1563.9923.3312.8562.4992.2221.9992925.06521.84419.18816.98315.14113.59011.1589.3698.0216.9836.5506.1655.5094.9744.5314.1583.9933.3312.8562.4992.2221.9993025.80722.39619.60017.29215.37213.76411.2579.4268.0557.0026.5656.1775.5164.9784.5334.1603.9953.3322.8562.4992.2221.9994032.83427.35523.11419.79217.15915.04611.9249.7798.2437.1056.6416.2335.5484.9964.5434.1653.9993.3332.8572.4992.2221.9995039.19631.42325.72921.48218.25515.76112.2339.9148.3047.1326.6606.2465.5544.9994.5454.1663.9993.3332.8572.4992.2221.999注:n为期数 爱华网

爱华网