The following is a step-by-stepdescription of a typical Letter of Credit transaction:

1. An Importer (Buyer) andExporter (Seller) agree on a purchase and sale of goods wherepayment is made by Letter of Credit.

2. The Importercompletes an application requesting its bank (Issuing Bank) toissue a Letter of Credit in favour of the Exporter. Note that theImporter must have a line of credit with the Issuing Bank in orderto request that a Letter of Credit be issued.

3. The Issuing Bank issues theLetter of Credit and sends it to the Advising Bank bytelecommunication or registered mail in accordance with theImporter’s instructions. A request may be included for the AdvisingBank to add its confirmation The Advising Bank istypically located in the country where the Exporter carries onbusiness and may be the Exporter’s bank but it does not havebe.

4. The AdvisingBank will verify the Letter of Credit for authenticity and send acopy to the Exporter.

5. The Exporterexamines the Letter of Credit to ensure: a) it corresponds to theterms and conditions in the purchase and sale agreement; b)documents stipulated in the Letter of Credit can be produced; andc) the terms and conditions of the Letter of Credit may befulfilled.

6. If the Exporter is unable tocomply with any term or condition of the Letter of Credit or if theLetter of Credit differs from the purchase and sale agreement, theExporter should immediately notify the Importer and request anamendment to the Letter of Credit.

7. When all parties agree to theamendments, they are incorporated into the terms of the Letter ofCredit and advised to the Exporter through the Advising Bank. It isrecommended that the Exporter does not make any shipments againstthe Letter of Credit until the required amendments have beenreceived.

8. The Exporter arranges forshipment of the goods, prepares and/or obtains the documentsspecified in the Letter of Credit and makes demand unde r the Letterof Credit by presenting the documents within the stated period andbefore the expiry date to the “available with” Bank. This may bethe Advising/Confirming Bank. That bank checks the documentsagainst the Letter of Credit and forwards them to the Issuing Bank.The drawing is negotiated, paid or accepted as the case maybe.

9. The Issuing Bank examines thedocuments to ensure they comply with the Letter of Credit terms andconditions. The Issuing Bank obtains payment from the Importer forpayment already made to the “available with” or the ConfirmingBank.

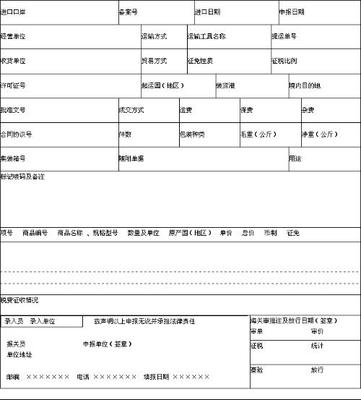

10. Documents are delivered to theImporter to allow them to take possession of the goods from thetransport company. The trade cycle is complete as the Importer hasreceived its goods and the Exporter has obtained payment. Note: Inthe diagram below, the Advising Bank is also acting as theConfirming Bank.

爱华网

爱华网